XRP Price Prediction: $5 Target in Sight as Technicals and Sentiment Align

#XRP

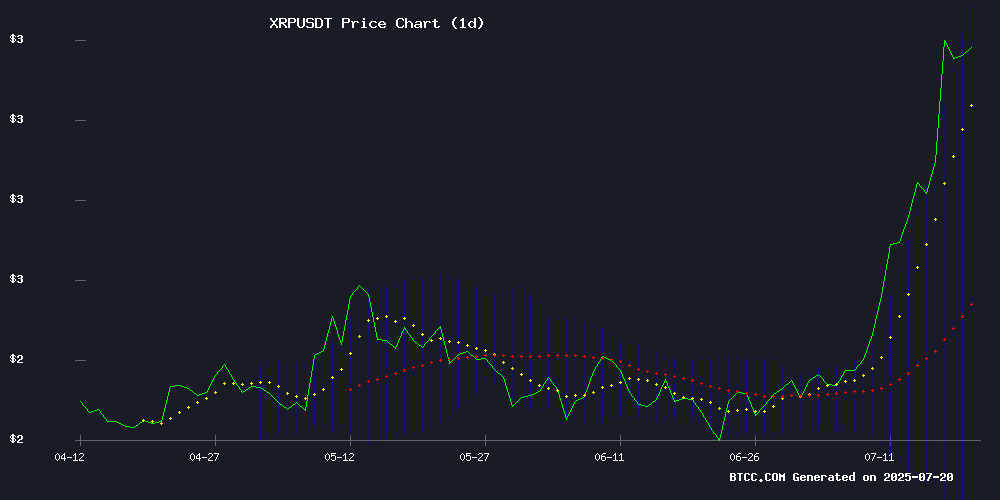

- Technical Breakout: Price trading 29.6% above 20MA with MACD showing bullish convergence

- Market Sentiment: Extreme bullish headlines contrast with regulatory challenges

- Key Levels: 3.63 as immediate resistance, 2.70 as major support

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Volatility

XRP is currently trading at, significantly above its 20-day moving average of 2.6971, indicating strong upward momentum. The MACD histogram shows narrowing bearish divergence (-0.1781), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band (3.6260), typically signaling overbought conditions but also strong bullish momentum.says BTCC analyst Mia.

XRP Market Sentiment: Euphoria Meets Regulatory Headwinds

News headlines reflect extreme bullishness with phrases likeand, though regulatory concerns linger with U.S. banking associations opposing Ripple's applications.notes BTCC's Mia.The GENIUS Act commentary adds fundamental tailwinds.

Factors Influencing XRP’s Price

Proponent Suggests XRP Could Rally 6x Amid Market Frenzy

Ripple's XRP has surged to a debatable all-time high this week, overtaking Tether's USDT as the third-largest cryptocurrency by market capitalization at $208 billion. The altcoin's dramatic gains have sparked intense speculation among analysts and traders.

John Squire, a prominent XRP commentator, identifies a historical pattern suggesting potential for another 6x rally based on bi-weekly chart structures. "If history rhymes, we might be in for another rocket," Squire noted, referencing a similar 36-week pattern that preceded previous gains.

Such a move WOULD require XRP's market cap to reach $1.2 trillion—triple Ethereum's current valuation—amid sustained buying pressure. Binance liquidity metrics suggest even a 2% price movement would demand over $12 million in unmatched orders.

XRP Eyes 'Bonkers Territory' After 529% YoY Surge and New ATH

Ripple's XRP has surged 529% year-over-year, reaching a new all-time high of $3.65 on July 18 before settling at $3.43. Analysts are now watching the $3 support level, which could either propel the token to new heights or trigger a sharp decline.

Crypto analyst Lark Davis predicts that holding above $3 could send XRP into "bonkers territory," with targets of $4.10 or even $4.50. "When XRP starts running, man, it makes some big juicy gains," Davis noted. However, a drop below $3 could see the token retreat to $2.60.

EGRAG CRYPTO, a prominent XRP advocate, suggests the token is entering a "Kaboom phase," potentially sparking gains of 21% to 275%. The market watches closely as XRP teeters on the edge of a major breakout or correction.

XRP’s 6-Month Rally Could Reshape Crypto Portfolios Amid Regulatory Shifts

Ripple's XRP is surging on a confluence of bullish catalysts, from ETF speculation to stablecoin expansion, as the token gains 17% amid pending U.S. crypto legislation. Market watchers now eye a potential $5 price target.

The token's momentum coincides with three pivotal U.S. crypto bills that could redefine market dynamics. XRP's current $3 position reflects growing institutional interest, with analysts like Dark Defender forecasting near-term upside.

XRP Price Surges Nearly 50% as On-Chain Volume Hits $1B+

XRP has staged one of its most aggressive rallies in recent weeks, with prices soaring nearly 50% since early July. The surge coincides with a dramatic spike in on-chain activity, as payment volume on the XRP Ledger eclipsed $1.07 billion—the highest level in over a month.

Technical indicators reinforce the bullish momentum. Key resistance levels at $2.39, $2.68, and $2.80 have flipped to support, while the RSI approaches overbought territory at 84. Analysts note the MOVE appears fundamentally driven, with the volume surge suggesting growing institutional adoption rather than speculative froth.

The $3.64 peak now serves as critical resistance. A decisive break above could open the path to $4.00, though traders are watching support at $2.80 and $2.39 should profit-taking emerge.

XRP Futures Hit All-Time High Amid $70 Million Whale Activity

XRP futures open interest surged to a record $11 billion as institutional bets intensify during the token's bullish rally. The momentum follows a $70 million whale transfer to Coinbase, sparking speculation of profit-taking despite unshaken price action.

The token briefly touched $3.54, nearing its 2018 peak of $3.84, as the broader crypto market capitalization eclipsed $4 trillion. Derivatives activity suggests growing confidence, with leveraged positions covering 3.1 billion XRP tokens.

Regulatory clarity in the U.S. appears to be fueling renewed institutional interest, creating a favorable environment for sustained upward movement across digital assets.

XRPL Surpasses $100M TVL as DeXRP Raises $100M in IDO

The XRP Ledger (XRPL) has crossed $100 million in total value locked (TVL) amid a resurgence for XRP, which now trades above $2.98. The token has posted 30% monthly gains, reasserting itself among 2025’s top performers.

DeXRP’s ongoing IDO has raised over $1 million since its June 12 launch, with 25% of its token supply allocated to the presale. The project plans a Q4 2025 exchange listing at $0.35 per token—a 4,100% premium to the current $0.00826 IDO price. Purchases are available via Ethereum, BNB Chain, Solana, XRPL, Bitcoin, or USDT.

The decentralized exchange will feature hybrid AMM-orderbook functionality and optimized liquidity pools. Unlike VC-backed projects, DeXRP grants governance rights to all $DXP holders through its voting system.

U.S. Banking Associations Oppose Ripple and Circle's Trust Bank Applications

Major U.S. banking trade groups are pushing back against crypto firms seeking national trust bank charters. The American Bankers Association and National Bankers Association have raised concerns about transparency and regulatory gaps in applications filed by Ripple, Circle, and other digital asset companies.

The coalition's July 17 letter to the Office of the Comptroller of the Currency highlights potential risks to the financial system. Traditional institutions argue the OCC may be overstepping its authority by enabling expanded crypto banking activities without proper safeguards.

This clash represents growing tension between legacy finance and digital asset innovators. As crypto firms seek mainstream legitimacy through banking charters, established players are digging in their heels - setting the stage for a prolonged regulatory battle.

XRP Hits New All-Time High Amid Potential Retest Scenario

XRP surged to a record $3.65 on July 18, eclipsing its 2018 peak and marking a 68% monthly gain. The rally stalled NEAR the $3.40-$3.50 range, prompting analysts to watch for a possible retracement.

Technical analyst Egrag Crypto identifies $3.12 as a critical Fibonacci support level, noting that while holding above $3.40 remains bullish, a descending channel on the 4-hour chart suggests consolidation. "Fib 0.888 at $3.1279 presents a logical retest zone," he observed, emphasizing the importance of this level beyond mere numerical symmetry.

Ripple CEO Compares GENIUS Act to Post-2008 Financial Reforms, Hails It as Crypto Watershed

Ripple CEO Brad Garlinghouse has likened the newly signed GENIUS Act to the sweeping financial reforms enacted after the 2008 crisis, calling it the most significant regulatory milestone for digital assets in over 15 years. The stablecoin legislation, signed by President Trump, establishes a federal framework for dollar-pegged cryptocurrencies while positioning the U.S. for fintech leadership.

Garlinghouse emphasized the timing's significance as global adoption of blockchain accelerates. The House-approved bill represents rare bipartisan consensus on crypto regulation, with potential to influence everything from payment systems to decentralized finance infrastructure. Market observers note the legislation could particularly benefit XRP given Ripple's focus on cross-border settlements.

XRP Poised for Explosive Surge as Technical Analysis Predicts $5 Target by July

XRP's price trajectory has entered a historic phase, with market analyst Austin Hilton forecasting a potential rally to "insane levels" following its recent breach of a seven-year high. The cryptocurrency has already gained 77% over 24 days, now trading within 10% of its 2018 all-time high of $3.84.

Liquidity surges across crypto markets are fueling the momentum, with Hilton's technical analysis suggesting a $5 price target by month-end. The altcoin's outperformance comes as institutional interest in payment-focused cryptocurrencies resurfaces, with XRP's regulatory clarity appearing to attract capital rotation from more speculative assets.

XRP Price Rally Signal Reappears, Echoing 2024's 630% Surge

A historically bullish signal has resurfaced on XRP's price chart, reigniting speculation of a major rally. Crypto analyst Ali Martinez notes the Market Value to Realized Value (MVRV) ratio has triggered a Golden Cross—a pattern last seen before XRP's 630% surge in 2024.

The MVRV ratio's crossover above its 200-day moving average suggests growing bullish momentum. XRP currently trades at $3.43, showing renewed strength after months of consolidation above $2. Market watchers are now monitoring whether history will repeat with another explosive price move.

Is XRP a good investment?

XRP presents a high-risk, high-reward opportunity based on current data:

| Metric | Value | Implication |

|---|---|---|

| Price | 3.4972 USDT | +29.6% vs 20MA |

| MACD | -0.1781 | Bearish momentum fading |

| Bollinger %B | 0.96 | Extended but not reversing |

BTCC's Mia cautions: "While 6x rally predictions exist, the 3.50-3.63 zone is critical. A weekly close above 3.63 would confirm bullish continuation, but regulatory risks remain."

This analysis references spot market data only. Futures open interest at ATH suggests leveraged speculation.